Benefits of Income Tax Return Filing

The Income Tax Return Filing online allows taxpayers to file their income tax returns anytime and anywhere through an online platform. The process of filing income tax returns online is called electronic filing. Electronic income tax filing is easy, fast, and can be done anywhere. Online ITR filing helps taxpayers to save money as they can easily file their returns electronically without hiring people who know the filing process.

Advent of ITR filing online

Taxpayers need to familiarize

themselves with the ITR filing online process ITR shall hire

professionals with the skills and knowledge of the e-filing process. These

professionals are known as Chartered Accountants and have acquired their skills

and knowledge through courses conducted by the best institutes in India. Preparing

and filing an income tax return is arduous and can be very long and tedious. To

make the process simple and uncomplicated, the Income Tax authorities have

designed an online filing process. The electronic application process has made

the process very simple, less time-consuming, and, most of all, accessible.

Electronic income tax filing has

many advantages to knowing how to file income tax returns, including

greater convenience, faster processing, and a less complicated and hassle-free

alternative to estimating your tax liability. The responsible departments have

made great efforts to ensure that citizens pay their taxes regularly and on

time. Further steps have been made to provide a new and purposeful positive

aspect to the domestic tax payment process.

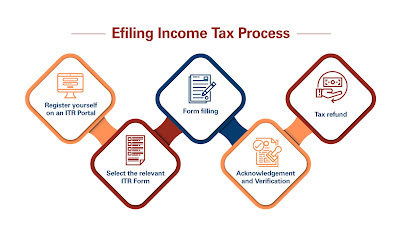

Guidelines for Online ITR Filing

The Online ITR Filing program

guides taxpayers through questions to determine income, taxes paid, deductions,

and anything else that affects their income tax return. Let us look at some

simple steps to file an IT declaration online.

• First of all, you have to log in

to the website of the Income Tax Department to File Income Tax Return.

It would help if you were cautious of illegal websites present in the web

world.

• Next, you must collect the

critical information required to file your return. We also need to collect

relevant information like deductions available and taxes prepaid.

• after that, log in to the website

and choose to file your Income Tax Return category-wise (individual, company,

etc.). For the first time, you need to create a personal account. Once you do

this, you can submit your return by logging into your account.

• When you click on a specific

return type, the income tax return file form will appear on your screen.

You need to enter a few details like income, employer, credits and deductions,

marital status, etc. Once you have entered all the details, the screen will

show you the amount you must pay or the refund you are entitled to.

Web Online ca is a secure and convenient online

tax preparation service offering excellent value on how to file income tax

return online. Prepare your IT return quickly and easily.

Very nice blog! Get free expert ca consult +91 9013318952 for Startup Registration, Trademark Registration, Shop Establishment Registration, Tobacco Manufacturer License, PF Registration & Return, 12AA Registration & Certificate

ReplyDelete